- The Benchmark

- Posts

- Solving the crypto adoption problem

Solving the crypto adoption problem

making crypto *actually* usable

Welcome back to The Benchmark, a weekly newsletter read by thousands brought to you by Alongside, where we cover the latest crypto news, interview builders in the space, and dive into new projects.

Market Check-in

Interview: Ouriel Ohayon, Founder & CEO at ZenGo

Each week, we interview crypto builders, share their stories, and what they are working on. Today, we’re featuring Ouriel, the Founder of ZenGo.

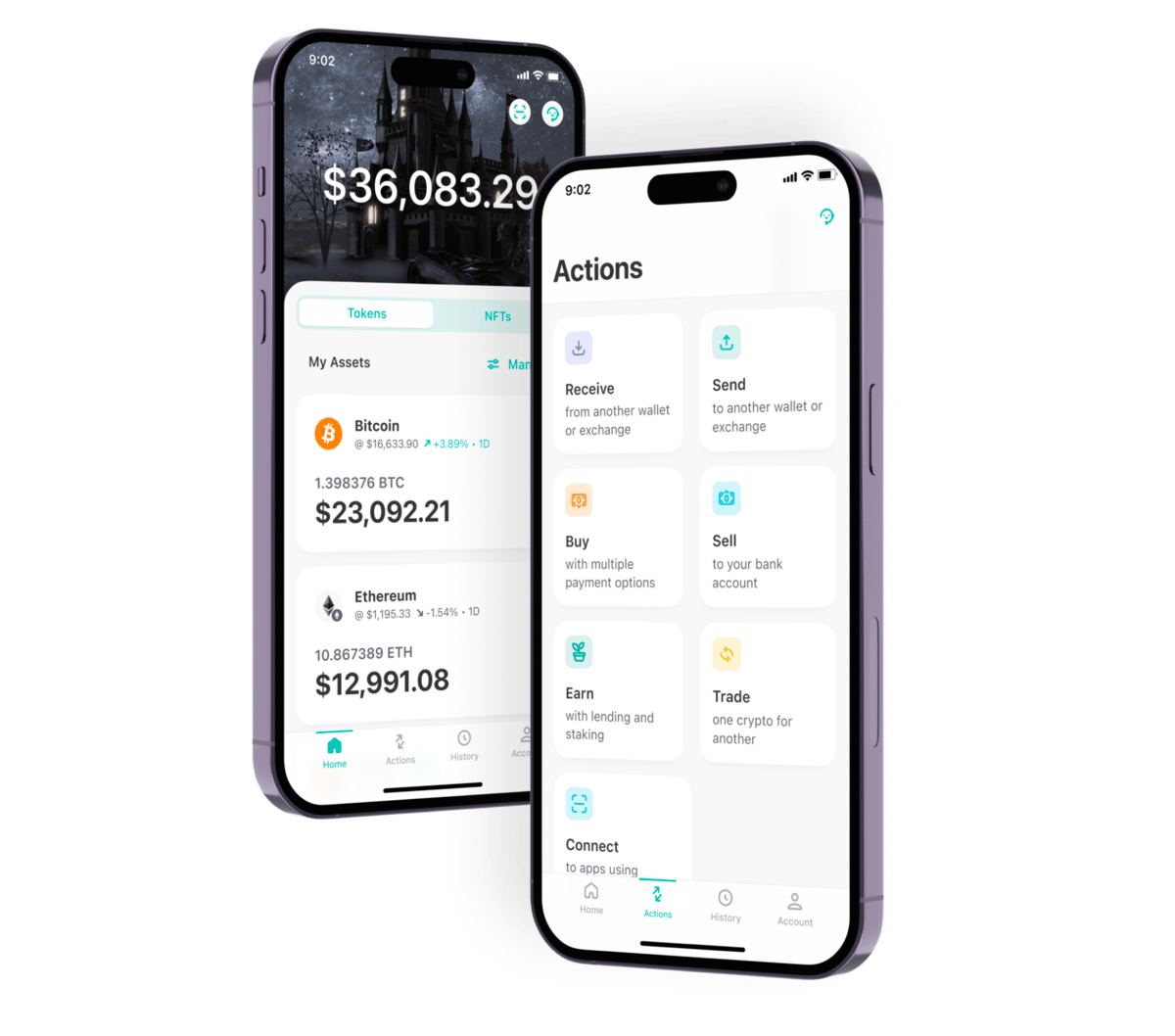

ZenGo is the most secure self-custodial wallet in crypto, with no seed phrase vulnerability powered by MPC technology. ZenGo focuses on building a beautiful, simple to use multi-chain personal wallet, while keeping your assets safe from human errors, exploits and scams.

Onto the interview:

What got you interested in Crypto?

The idea that you can opt-out of the financial system and become an actor in control of your own wealth was ground breaking to me. This is a first in the history of capitalism. My way into crypto was through Ethereum when I listened to a podcast with Nick Szabo on the ability to create unstoppable apps where you don’t experience platform risk. Since I had heard a lot of horror stories where platforms could censor companies and kill projects from one day to the next in the web2 world, that gave me the desire to learn.

Where did ZenGo start?

I was deeply frustrated with existing wallets and private keys 5 years ago, and could not imagine this could be the future. I thought of other ways to provide wallet infrastructure for users but with safer and simpler ux. That was the starting point for ZenGo.

What is ZenGo’s north star?

Our goal is that no ZenGo user ever loses their crypto while providing a delightful service, which has been the case until today. Everything we build is so that it remains that way. This is a lofty and ambitious goal in a world where so many things can go wrong.

Why no seed phrases?

We believe that seed phrases cannot be the way people are going to handle their wealth in the future because it requires too much knowledge to safeguard them – Which has been proven time and time again. Most people store their crypto on a custodial exchange to this day. Seed phrases are single factor security systems and there is a reason why so many wallet players are trying (and not succeeding) to find a way around it. We believe in the powers of multi-factor security by default with a passwordless elegant security experience.

What do you think makes people have their crypto ah-ha moment?

People need to try it. Once you send a transaction and compare it to traditional systems like sending a bank wire or even a modern venmo transaction, it tends to click. In particular when sending crypto to someone abroad.

How do you recommend people learn about crypto?

I always say that you should get a wallet, and make your first small transaction. Try a few decentralized apps like Uniswap or minting a free NFT and then read more about crypto. It’s like learning to ride a bike or surf – the power of just trying things out first hand trumps just reading about it. Podcasts are great resources too.

What is the biggest challenge to broad crypto adoption today?

Crypto has a serious reputation and branding problem outside of the industry. Attracting good talent, Building better solutions and products is a good way to rectify that terrible branding. It will be a meaningful effort and will take a long time, but we have to be focused on building a better reputation.

This Week in Crypto

Decentralized exchanges are taking over.

According to The Block, CEXs are experiencing a large drop in trading volumes, hitting their lowest levels for the year , while decentralized exchanges (DEXes) maintain steady volumes. This shift is reflected in the DEX to CEX ratio, which has reached an all-time high of over 20%, while it has typically trended around 10%. This is largely attributed to the recent surge in popularity of memecoins. Memecoins like Pepe saw trading volumes on Ethereum-based DEXes exceed $600 million on May 5. Exchanges like Binance, Huobi, and Poloniex have tried to capitalize on that interest by listing these types of coins.

U.S. Debt Deal’s impact on Bitcoin?

As the U.S. government negotiates to raise its $31.4 trillion debt limit, some analysts warn that a potential deal could negatively impact the crypto market. The U.S. Treasury has been running down its Treasury General Account (TGA) balance to keep the government functioning, which has kept assets like Bitcoin buoyant amid fears of government default and continued Federal Reserve rate hikes.

Once the debt limit is raised, the Treasury will likely issue government bonds to rebuild its cash balance, potentially draining liquidity from the system and putting upward pressure on bond yields. This could negatively affect Bitcoin, which typically moves inversely to bond yields. The issuance of more U.S. government debt could increase public spending, boosting the economy and further delaying the likelihood of rate cuts, which could also be detrimental to Bitcoin.

Senator Warren proposes bill to ban crypto

Senators Elizabeth Warren and Roger Marshall are promoting the Digital Asset Anti-Money Laundering Act, which aims to prevent money laundering through cryptocurrencies. Critics argue that the bill, which treats software developers and transaction validators as financial institutions, is a strategic move to ban cryptocurrencies. For context, Senator Warren has been clear in her intentions to build an anti-crypto army. Critics claim that while money laundering is a real issue, it is not unique to crypto and is mostly conducted through fiat currencies. The proposed legislation, they argue, does not address genuine gaps in anti-money laundering laws and could do more harm than good by potentially collapsing the crypto economy. Despite these concerns, there is consensus that efforts should be made to reduce money laundering in both crypto and traditional assets.

More reading from this week

1/ Tokenized Bonds see adoption

2/ Vitalik’s latest post just dropped

3/ DCG Misses a payment.

4/ Happy Bitcoin Pizza Day! (May 22)

What does the data say about actively trading your portfolio? Does active beat passive in investing?

First, quick definitions: Passive investing involves buying and holding a diversified mix of assets for the long term, to "track the market" over time. Active trading involves frequent buying and selling of assets, attempting to profit and "beat the market".

The same researchers published "Do Day Traders Rationally Learn About Their Ability?" in 2009. They analyzed 15 years of day trading data in Taiwan. What happened? Less than 1% of day traders could consistently earn profits net of fees.

The same 2009 study revealed that the majority (over 75%) of traders quit within 2 years due to consistent losses. Only a few kept going.

Barber and Odean's earlier work in 2000, "Trading Is Hazardous to Your Wealth", also shows similar results: - Average investors underperformed the market by 2.3% - The most active traders underperformed the market by 6.5% In other words, the more they traded, the less they made

Want more proof? Garvey and Murphy's 2005 study 'Retail Day Traders and Direct Access Brokers' also took a look into day trading. What happened? In a 5-month observation period, over 70% of the traders lost money.

What's the takeaway? Most traders lose money, and would be better off buying the market. This is why AMKT exists, a passive index that tracks the crypto market, because if you can't beat the market, you might as well join it.

Learn more about $AMKT, the Crypto Market Index, here.

If you are receiving this email, you signed up to receive email communications from Alongside in the last year.

DISCLAIMER: This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.